inheritance tax calculator florida

If the inheritance tax is paid within nine months of date of decedents death a 5 percent discount is allowed. Inheritance and Estate Taxes.

Va Loan Calculator For Florida Mortgage Loan Calculator Va Loan Calculator Va Loan

The following is a list of interactive forms.

. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Florida also has no gift tax. However certain remainder interests are still subject to the inheritance tax.

You would receive 950000. Today Virginia no longer has an estate tax or inheritance tax. Youll need to check the laws of the state where the person you are inheriting from lived.

The estate would pay 50000 5 in estate taxes. The tax due should be paid when the return is filed. The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the lifetime limit 11700000 in 2021.

Inheritance tax of 40 is paid on what you leave to your heirs. Easily Calculate Your Tax Refund And Get Started On Filing Your Taxes. Florida has no estate or inheritance tax and property and sales tax rates are close to national marks.

For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax. Heres how estate and inheritance taxes would work. An inheritance tax is usually paid by a person inheriting an estate.

Maryland is the only state to impose both. Ad Get A Quick Estimate On How Much You May Get Back Or Owe With Our Free Calculator. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. Enter your financial details to calculate your taxes Add Pension You will pay 0 of Florida state taxes on your pre-tax income of 40000 Your Tax Breakdown Federal 1731. Enter in your assets and any debts and well show you how much your estate is worth - and an estimate of how much could be subject to inheritance tax.

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Inheritance Estate Tax. The tax rate varies depending on the relationship of the heir to the decedent.

Inheritance tax calculator Enter your details below and find out how much inheritance tax youll pay. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Use our inheritance tax calculator plus find out inheritance tax rates and how it works.

Proper estate planning can lower the value of an estate such that no or minimal taxes are owed. Impose estate taxes and six impose inheritance taxes. These forms may be.

The major difference between estate tax and inheritance tax is who pays the tax. On or After 112022. Fortunately there is an exemption called the Unified Credit which lessens the blow for most estates.

You would pay 95000 10 in inheritance taxes. If you have 5 million or less congratulations. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

To find a financial advisor near you try our free online matching tool. There is no federal inheritance tax but there is a federal estate tax. The calculator has been updated with the inheritance tax allowances for the 2020-21 tax year.

In 2021 federal estate tax generally applies to assets over 117 million. The estate tax is paid based on the deceased persons estate before the money is distributed but inheritance tax is paid by the person inheriting or receiving the money. The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance.

Thats right there is no estate tax for the vast majority of US citizens. Twelve states and Washington DC. 112021 - 12312021.

See How Easy It Is. 3 Oversee property tax. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

Florida taxes corporations by using the companys federal taxable income and allowing for. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. There is no inheritance tax or estate tax in Florida.

However if the beneficiarys net inheritance tax liability exceeds 5000 and the return is filed timely an election can be made to pay the tax in 10 equal annual installments. COVID-19 Update on Inheritance Tax Returns. To have your Inheritance and Estate Tax questions answered by a Division representative inquire as to the status of an Inheritance or Estate Tax matter or have Inheritance and Estate Tax forms mailed to you contact the Inheritance and Estate Tax Service Center by.

Inheritance and Estate Taxes are two separate taxes that are often referred to as death taxes since both are occasioned by the death of a property owner. Kentucky Inheritance and Estate Tax Laws can be found in the Kentucky Revised Statutes under Chapters. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607.

In Pennsylvania for instance the inheritance tax may apply to you even if you live out of state as long as the deceased lived in the state. Understanding Florida Inheritance Tax Law. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax.

Florida Corporate Tax Rate. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. In Wills Probate Forms.

U S Estate Tax Calculator Altro Llp

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

Legacy Assurance Plan Pointing About The Federal Estate Tax And How This Tax May Affect Larger Estate Planning Estate Planning Checklist Revocable Living Trust

Capital Gains Tax Calculator 2022 Casaplorer

2021 Estate Income Tax Calculator Rates

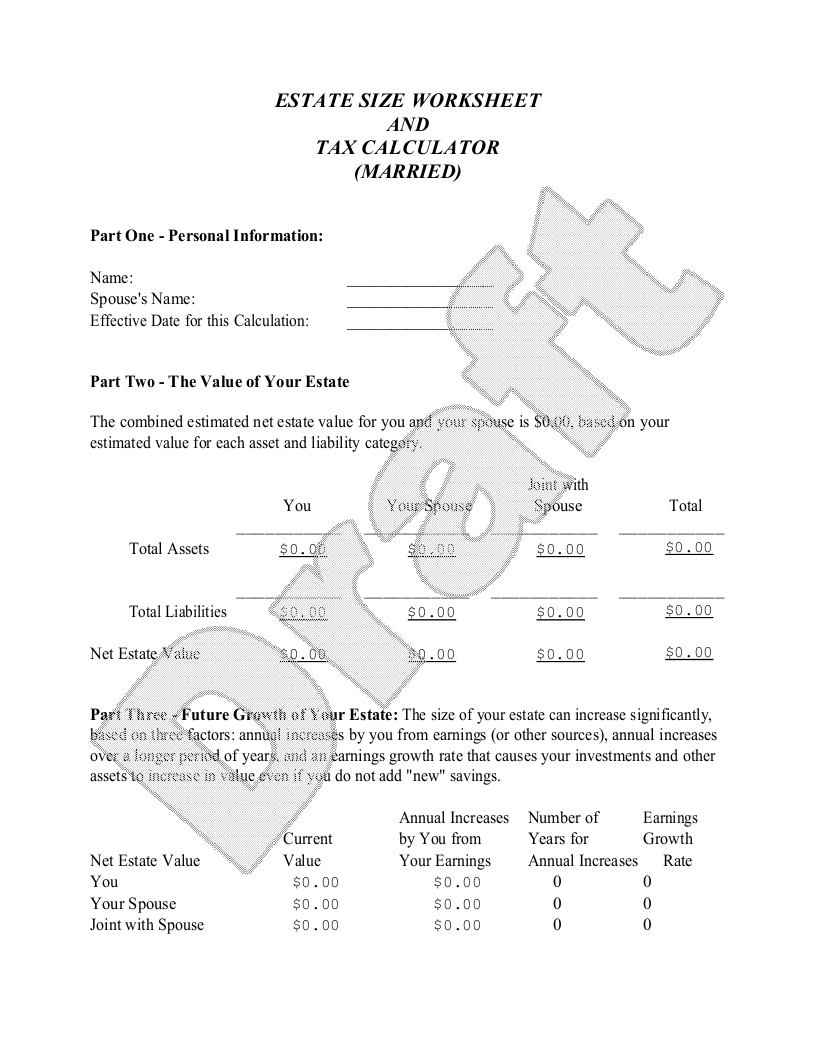

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Florida Income Tax Calculator Smartasset

Free Crypto Tax Calculator How To Calculate Cryptocurrency Taxes Zenledger